Digital estate planning: why is it better and how to get started with it?

Lack of time, fragmented documentation, evolving legislation, ... As an entrepreneur it is not an easy task to manage your estate and cash flow planning. It pays to digitalise your estate planning because that way you get a better view and grip on it. And we can help with that. Thus, in addition to personal advice, we also offer a digital collaboration platform: VGD Pax Familia.

Our Estate Planning business line supports entrepreneurs in everything what has to do with estate, pension, cash flow and inheritance planning. Just like in our other business lines we do this as advanced as possible and we help you digitalise where necessary.

WHY DIGITALISE?

In the past you could not do otherwise, but nowadays a paper-based or offline estate planning is needlessly complex. To begin with, it makes it very difficult to compare your estate, pension and cash flow planning. In addition, you quickly pile up a lot of (delicate) documents and folders that you do not want to lose just like that: think of marriage contracts, wills, gift documents, financial forecasts ... Our estate planners are happy to help you digitalise it all.

Your advantages?

- Sensitive data is better stored and secured

- Figures can be updated anytime, anywhere

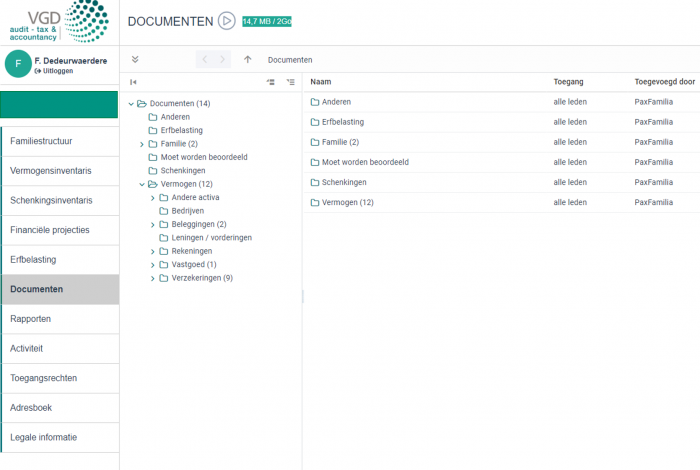

- Documents come in a digital vault

- On these data we can make calculations and projections which are immediately available;

- Last but not least: our experts do all of this by usinge one simple tool: VGD Pax Familia!

WHAT IS VGD PAX FAMILIA?

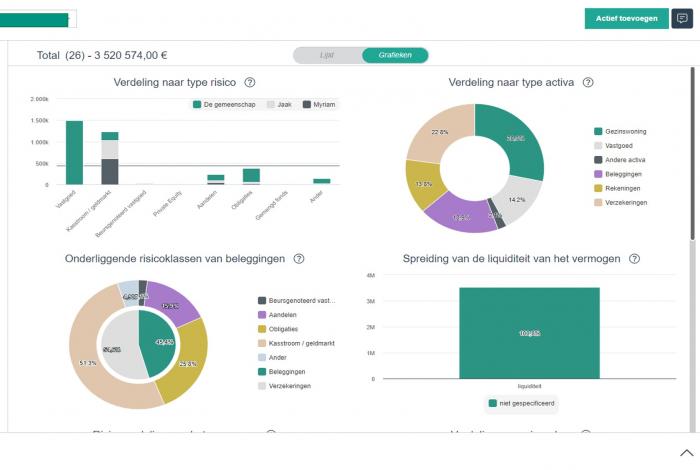

A user-friendly, secure and digital platform on which you decide who gets access besides your VGD estate planner. The platform gives you

a clear view of your entire estate and allows you to keep better track of your estate.

Cash Flow Planning: private vs. professional

VGD Pax Familia is the tool of choice for your private cash flow planning. It gives you a detailed view of all your income and expenses. With the financial projections, possible shortages can be detected in time.

Looking for tools to launch, automate or optimise your company's cash flow planning? Then be sure to take a look at our CFO services business line.

HOW TO WORK WITH VGD PAX FAMILIA?

The tool gives context to information by organising it into family and business structures. It takes into account the marriage regime and the ownership structure of each asset. The platform consists of three components:

- A graphical representation of your estate balance, including your real estate types, costs, income ...

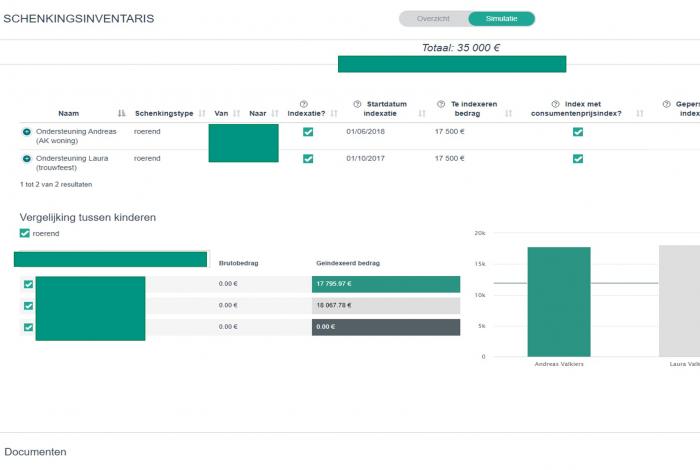

- An inventory of gifts you already made.

- A digital vault to preserve documents such as marriage contracts, wills and gift agreements

VGD Pax Familia

Who has access?

Your account is accessible 24/7. Only you and your advisor have access, but you can also grant others - such as your spouse, children, grandchildren or a civil law notary - whether or not limited access to the platform.

Safety guaranteed

VGD Pax Familia meets the highest banking sector standards in terms of security and confidentiality: data encryption during data transfer and at rest, two-factor authentication, activity log, Account Information Service Provider (AISP), regular backups, GDPR conformity, and so on.

Digital reporting: faster and better

Thanks to the platform, you do not only gain insight, but also time. This way you do not always have to meet face-to-face with your advisor and both your advisor and you dispose of the same information.

Getting down to business?

Do not hesitate to contact our Estate Planning advisors